Tenant Insurance

SELF STORAGE TENANT INSURANCE PROGRAM

We understand that the personal property you store in your storage unit is valuable and important to you. However, our storage facility is not responsible for property stored at our facility. That is why our lease requires that each tenant maintain insurance coverage on their stored property. Some, but not all, homeowners’ and renters’ insurance policies cover property stored in self-storage facilities. You should contact your insurance agent to confirm whether your insurance policy will cover the property you store at our facility, and ask your agent about applicable policy deductibles and exclusions.

As a convenience, we make available to our tenants a Self Storage Tenant Insurance Program administered by Xercor Insurance Services LLC. This insurance coverage satisfies your lease obligations, and premiums are collected monthly when you pay the rent for your storage unit. The Self Storage Tenant Insurance Program is underwritten by one of the most reputable carriers in the marketplace. The owner of the storage facility receives a fixed portion of each monthly insurance premium. The owner of the storage facility has retained the management services of SKS Management, LLC, “Operator”. Operator assists Xercor Insurance Services, LLC in enrolling tenants in its insurance program and collecting the monthly premium. Xercor has the sole authority to compromise, pay or deny tenant insurance claims. The outcome of a tenant insurance claim has absolutely no effect on the income of owner or Operator.

Again, you are not required to purchase insurance through Xercor Program, but you are required to maintain insurance. Please see below for answers to Frequently Asked Questions about Xercor’s Self Storage Tenant Insurance Program.

XERCOR HAS PROVIDED ANSWERS TO THESE FREQUENTLY ASKED QUESTIONS ABOUT THE SELF STORAGE TENANT INSURANCE PROGRAM

Q: What levels of coverage are available under the Self Storage Tenant Insurance Program?

A. Three levels of coverage limits are offered under the Program: $3,000, $4,000 or $5,000. Monthly Premiums are $12, $14 or $16, depending on the policy limit you choose.

Q: What losses does the Self Storage Tenant Insurance Program cover?

A. The Program protects your stored property against damage or loss from over thirty perils, including fire, lightning, windstorm, hail, tornados, hurricanes and other perils, like burglary and vandalism, all subject to a $100 deductible for each claim. For a complete list of covered causes of loss, see the sample certificate of insurance at our facility. You also can obtain a copy of the insurance certificate by contacting the Program Administrator, Xercor Insurance Services LLC, at 1-844-769-2904.

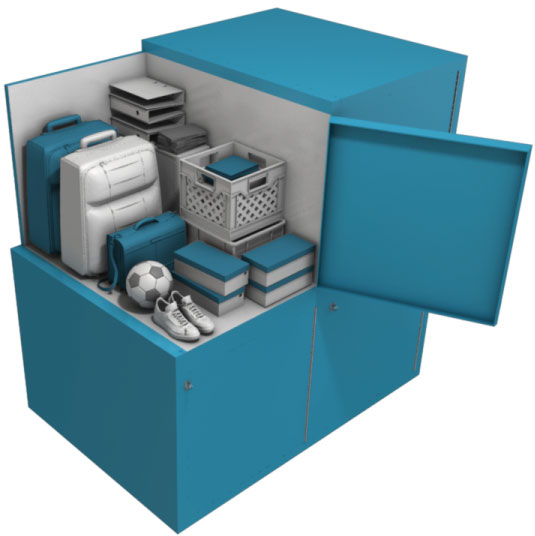

Q: What types of property does the Self Storage Tenant Insurance Program cover?

A. Most types of personal property are covered under the Program. However, there are some exclusions, such as: firearms, photographic equipment, currency, contracts, securities, lottery tickets, precious metals, jewelry, watches, fur, food, alcohol and other specifically identified exclusions. To see a complete list of the property excluded, see the sample certificate at our facility or call the Program Administrator, Xercor Insurance Services LLC at 1-844-769-2904.

- $1,000 for loss or damage from flood

- $500 for mold, mildew, fungus, wet or dry rot damage

- $500 for vermin, rodents, moths or insect damage

Q: When does coverage start? When does coverage expire?

A. Coverage begins when you complete and sign the Enrollment Form and pay the first month’s premium. Coverage ends when your rental agreement terminates or upon your failure to pay your monthly premium, in which event you will receive a Xercor date of termination notice.

Q: Can the personnel at the storage facility answer my questions about matters of coverage?

A. Personnel at the facility are not authorized to answer Tenant questions about coverage. You must contact Xercor.

Q: If I’m insured under the Program, how do I file a claim if I suffer a covered loss?

A. All claims for losses should be directed to the Program Administrator, Xercor Insurance Services LLC, by calling 1-844-769-2904. You also may submit a claim through Xercor’s website, www.xercor.com.